What does hodl mean in crypto

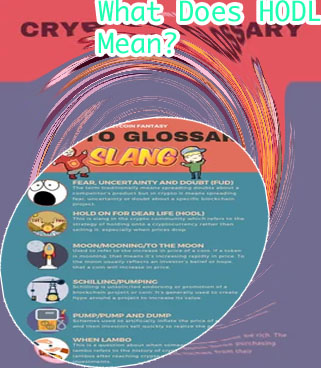

Understanding the term "hodl" is essential for anyone interested in the world of cryptocurrency. It is a slang term that originated from a misspelling of "hold" and has since become a popular phrase within the crypto community. To fully grasp the meaning and significance of hodl, it's important to explore different perspectives and explanations. The following articles will provide valuable insights into what hodl means in crypto:

The Origins and Importance of Hodl in the Cryptocurrency World

"The Origins and Importance of Hodl in the Cryptocurrency World" have become deeply ingrained in the culture of the digital asset community. The term "Hodl" originated from a typo in a 2013 Bitcoin forum post, where a user misspelled "hold" in a moment of excitement. Since then, it has become a mantra for many cryptocurrency investors, emphasizing the importance of holding onto their assets despite market fluctuations.

One of the most famous incidents involving Hodl occurred during the 2017 cryptocurrency bull run when Bitcoin's price skyrocketed to nearly ,000. Despite the temptation to sell at such high prices, many investors chose to Hodl onto their assets, believing in the long-term potential of cryptocurrencies. This dedication to Hodl paid off for many, as Bitcoin and other cryptocurrencies have continued to reach new all-time highs in the years since.

The concept of Hodl is not just about holding onto assets during times of growth, but also during market downturns. It encourages investors to have a long-term perspective and not panic sell when prices are falling. This mindset is crucial in the volatile world of cryptocurrencies, where prices can fluctuate dramatically in a short period.

Hodl: A Beginner's Guide to Holding Cryptocurrency for the Long Term

Today, we have with us a crypto enthusiast who recently read a book on long-term cryptocurrency investment. Can you tell us a bit about your experience with the book?

Sure! I recently came across a book that focused on the concept of "Hodling" in the world of cryptocurrency. The book provided a comprehensive guide for beginners on how to hold onto their digital assets for the long term, rather than engaging in frequent trading. It emphasized the importance of patience and strategic decision-making when it comes to investing in cryptocurrencies.

That sounds intriguing. What were some key takeaways from the book?

One key takeaway was the idea of ignoring short-term price fluctuations and focusing on the long-term potential of the projects you invest in. The book also highlighted the significance of conducting thorough research before investing in any cryptocurrency, as well as the importance of diversifying your portfolio to mitigate risks.

How do you think this book is important for individuals interested in long-term cryptocurrency investment?

I believe this book serves as a valuable resource for beginners looking to navigate the complex world of cryptocurrency investment. By stressing the importance of holding onto assets for the long term, rather than succumbing to impulsive trading, the book empowers readers to make informed decisions that can potentially lead to long-term financial gains. Overall, it