Crypto price data

As the popularity of cryptocurrencies continues to grow, obtaining accurate and up-to-date price data is essential for investors and traders. In this list of articles, we will explore various strategies and tools to help solve the topic of "Crypto price data" and make informed decisions in the volatile world of digital assets.

How to Use API Integration for Real-Time Crypto Price Data

API integration for real-time crypto price data is a crucial aspect of cryptocurrency trading. By connecting to various APIs, traders can access up-to-date information on prices, trends, and market movements. This data is essential for making informed investment decisions and staying ahead of the competition in the volatile world of cryptocurrency.

One popular API for accessing real-time crypto price data is the CoinGecko API. This API provides a wealth of information on thousands of cryptocurrencies, including price, market cap, volume, and more. By integrating the CoinGecko API into their trading platforms, traders can stay informed about the latest developments in the market and make quick decisions based on real-time data.

Another important aspect of API integration for real-time crypto price data is automation. By using APIs to access price data, traders can automate their trading strategies and execute trades quickly and efficiently. This can help them take advantage of market opportunities as soon as they arise, without the need for manual intervention.

In conclusion, API integration is a powerful tool for accessing real-time crypto price data and staying ahead of the curve in the fast-paced world of cryptocurrency trading. By leveraging APIs like the CoinGecko API, traders can access up-to-date information, automate their trading strategies, and make informed decisions based on real-time data.

Top Cryptocurrency Price Tracking Websites and Apps

Cryptocurrency enthusiasts around the world rely on various websites and apps to keep track of the ever-changing prices of digital assets. These platforms provide real-time updates, historical data, and analysis tools to help users make informed decisions when buying, selling, or trading cryptocurrencies.

One popular website for tracking cryptocurrency prices is CoinMarketCap. This platform offers a comprehensive overview of the cryptocurrency market, including price charts, market capitalization, trading volume, and price changes over various time periods. Users can also create watchlists to monitor their favorite cryptocurrencies and set up price alerts to stay updated on market movements.

Another useful app for tracking cryptocurrency prices is Blockfolio. This mobile application allows users to track their portfolio of digital assets across multiple exchanges, view price charts, and receive real-time price updates. Blockfolio also offers news and analysis to help users stay informed about the latest developments in the cryptocurrency market.

As a resident of a bustling city in World, John Smith from London finds these cryptocurrency price tracking websites and apps invaluable in managing his investment portfolio. "I use CoinMarketCap and Blockfolio daily to monitor the prices of my cryptocurrency holdings and make informed trading decisions," says Smith. "Having access to real-time price data and analysis tools has helped me navigate the volatile cryptocurrency market with confidence." With the

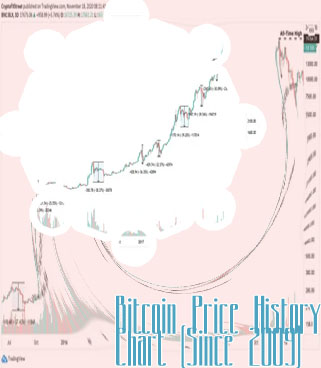

Analyzing Historical Crypto Price Data for Investment Strategies

Cryptocurrency investing is becoming increasingly popular among investors worldwide. One key strategy that many investors use is analyzing historical price data to make informed decisions. By studying past price movements, investors can gain valuable insights into potential future trends and price fluctuations.

There are several key benefits to analyzing historical crypto price data for investment strategies:

-

Identifying Patterns: By analyzing historical price data, investors can identify patterns and trends that may help predict future price movements. This can be particularly useful for short-term traders looking to capitalize on market fluctuations.

-

Risk Management: Studying historical price data can also help investors assess and manage risk more effectively. By understanding how prices have behaved in the past, investors can make more informed decisions about when to buy or sell, potentially reducing the risk of significant losses.

-

Enhancing Decision Making: Historical price data can provide valuable insights that can enhance decision-making processes. By using this data to inform investment strategies, investors can make more confident and well-informed choices, potentially leading to higher returns on their investments.

-

Backtesting Strategies: Investors can also use historical price data to backtest their investment strategies. By simulating how a particular strategy would have performed in the past, investors can gain a better understanding of its potential effectiveness in different

Utilizing Technical Analysis Tools for Crypto Price Predictions

Cryptocurrency markets are known for their volatility, making it challenging for investors to predict price movements accurately. However, by utilizing technical analysis tools, traders can gain valuable insights into market trends and make more informed decisions. Technical analysis involves studying historical price data and using various indicators to forecast future price movements.

One of the most popular technical analysis tools used in the cryptocurrency market is the Moving Average Convergence Divergence (MACD) indicator. This indicator helps traders identify potential buy or sell signals based on the convergence or divergence of two moving averages. By analyzing the MACD indicator, traders can anticipate changes in market trends and adjust their trading strategies accordingly.

Another essential tool for predicting crypto price movements is the Relative Strength Index (RSI). The RSI measures the speed and change of price movements, indicating whether a particular cryptocurrency is overbought or oversold. By monitoring the RSI, traders can determine the optimal time to enter or exit a trade and maximize their profits.

In addition to these tools, traders can also use support and resistance levels to identify key price levels where a cryptocurrency is likely to reverse course. By combining these technical analysis tools, traders can develop a comprehensive trading strategy that increases their chances of success in the volatile crypto market.