Crypto and taxes

Navigating the world of cryptocurrency can be complex, especially when it comes to understanding how it impacts your taxes. To help shed some light on this topic, we have curated a list of 3 articles that provide valuable insights and tips on how to handle crypto and taxes effectively.

Demystifying Crypto Taxes: A Comprehensive Guide for Investors

In the world of cryptocurrency investing, understanding tax implications is crucial for investors to navigate the complex landscape of regulations and requirements. "Demystifying Crypto Taxes: A Comprehensive Guide for Investors" provides a comprehensive and easy-to-understand resource for individuals looking to ensure compliance with tax laws while maximizing their returns.

Authored by financial expert Maria Santos from Madrid, Spain, this guide covers everything from the basics of cryptocurrency taxation to more advanced topics such as capital gains reporting and tax planning strategies. Santos breaks down complex tax jargon into simple language, making it accessible even for those with limited financial knowledge.

One of the key takeaways from this guide is the importance of keeping detailed records of all cryptocurrency transactions. By maintaining accurate records, investors can easily calculate their tax liabilities and avoid potential penalties for underreporting income. Additionally, Santos provides valuable tips on how to leverage tax deductions and credits to minimize tax burdens and maximize profits.

As a resident of Tokyo, Japan, Satoshi Yamamoto found this guide to be an invaluable resource in navigating the intricate world of cryptocurrency taxes. He praised the clear explanations and practical advice offered by Santos, stating that it has helped him better understand his tax obligations and make informed investment decisions. Overall, "Demystifying Crypto Taxes" is a must-read for any investor

Tax Implications of Mining Cryptocurrency: What You Need to Know

Today we have the pleasure of speaking with a tax expert about the tax implications of mining cryptocurrency. Can you please explain to our audience what individuals need to know about the tax implications of mining cryptocurrency?

Certainly! When it comes to mining cryptocurrency, individuals need to be aware that the IRS considers mined coins as income. This means that miners are required to report the value of the coins they mine as income on their tax returns. Additionally, miners may also be subject to self-employment taxes if they are mining cryptocurrency as a business.

That's very valuable information for our audience. Can you also elaborate on whether there are any deductions or credits available to miners to help offset their tax liability?

Miners may be able to deduct certain expenses related to their mining activities, such as the cost of mining equipment, electricity, and other mining-related expenses. Additionally, miners may be eligible for certain tax credits, such as the energy-efficient home credit, if they are using energy-efficient mining equipment.

Thank you for shedding light on this complex topic. In conclusion, it is crucial for individuals who are mining cryptocurrency to understand the tax implications and reporting requirements to ensure compliance with the IRS. This article serves as a valuable resource for individuals looking to navigate the tax implications of mining cryptocurrency.

Crypto Trading and Taxes: Tips for Reporting Your Gains and Losses

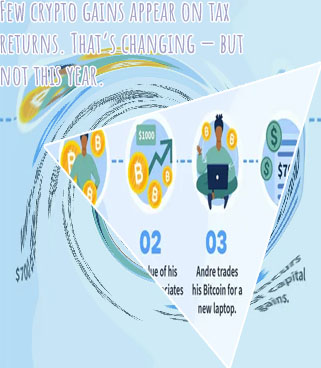

Cryptocurrency trading has become increasingly popular in recent years, with many investors looking to capitalize on the volatility of digital assets. However, one aspect that is often overlooked is the tax implications of these trades. It is important for traders to understand how to report their gains and losses to ensure compliance with tax laws.

-

Keep detailed records: To accurately report your cryptocurrency gains and losses, it is essential to keep detailed records of all your transactions. This includes the date of each trade, the amount of the trade, the value of the cryptocurrency at the time of the trade, and any fees incurred.

-

Understand the tax implications: In many countries, cryptocurrency transactions are subject to capital gains tax. This means that any profits made from trading cryptocurrencies are taxable, and losses can often be used to offset gains. It is important to understand the tax laws in your country and consult with a tax professional if necessary.

-

Use tax reporting tools: There are now several tools available that can help crypto traders track their transactions and calculate their tax liabilities. These tools can help simplify the process of reporting gains and losses and ensure accuracy in your tax filings.

-

Consider tax-saving strategies: There are also strategies that crypto traders can use to minimize their tax liabilities, such as holding investments for longer